- June 29, 2023

- 127 Views

Picture this: a world where traditional banking transforms into a cutting-edge, efficient, and transparent system that leaves everyone in awe. Blockchain, often met with skepticism and uncertainty, is slowly but surely revolutionizing the financial services we know today.

The journey may still have some winding paths, but the groundwork has been laid. With continuous innovation, the day will come when "blockchain and banking" will roll off the tongue as easily as any everyday conversation topic.

Now, how exactly is blockchain reshaping the banking landscape? What are the remarkable benefits arising from this unique collaboration?

Prepare to dive deep into the captivating connection between blockchain and banking, where we uncover the extraordinary potential for financial institutions to enhance their services through this game-changing technology.

What Are the Problems in Banking Today?

Despite its long history, the banking industry faces numerous challenges in the modern era. One prominent issue is the industry's sluggishness in adapting to the fast-paced changes brought about by the digital age.

Over time, banks have become slow to implement technological advancements and struggle to meet customers' evolving needs.

One notable problem is the excessive reliance on paperwork for various banking operations. This reliance incurs significant time and financial costs and introduces security vulnerabilities.

Enhancing security systems across the industry has become a pressing concern. Moreover, banks need effective solutions to track credit history better, reduce instances of bad credit, and improve regulatory compliance.

These areas require innovation and technological upgrades to streamline processes and ensure efficient operations. Adding to the challenges, the banking sector faces increasing competition from the rapidly growing fintech industry.

Fintech companies leverage technology to provide innovative financial services, offering customers more convenient and efficient alternatives to traditional banking.

To stay relevant and meet the demands of the digital age, the banking industry must address these pressing issues, embrace technological advancements, and foster collaboration with fintech companies to drive innovation in the sector.

Blockchain in Banking Industry: Market Statistics

- The estimated market size for blockchain solutions in the banking system and financial institutions was $0.28 billion in 2018. However, it is projected that the utilization of blockchain technology within the financial sector will experience significant growth in the coming years, with a forecasted market size of around $22.5 billion by 2026.

- The global market for blockchain in the banking and financial services sector reached approximately $2,034.1 million in 2021, reflecting a compound annual growth rate (CAGR) of 62.7% since 2016.

This market will expand from $2,034.1 million in 2021 to $17,583.4 million in 2026 at a growth rate of 53.9%. Subsequently, it is projected to experience a CAGR of 27.9% from 2026 onwards and reach a market value of $60,270.6 million by 2031.

Benefits of Blockchain in Banking

Blockchain technology offers several advantages for the banking industry. Here are some key benefits of blockchain in banking:

- Cost reduction: Blockchain technology can eliminate inefficiencies across the banking industry, reducing the reliance on intermediaries and delivering significant cost savings. Blockchain can improve speed and efficiency by streamlining processes like clearing and settlement, potentially saving banks billions of dollars.

- Robust security: Blockchain enhances security in banking by providing cryptographic verification of identities and creating a decentralized network that eliminates single points of failure. It can also be used to develop robust know-your-customer (KYC) solutions and reduce the risk of data breaches, cyber-attacks, and human errors.

- Instant payments and money transfers: Blockchain protocols enable direct and peer-to-peer transactions, removing the need for intermediaries like SWIFT for cross-border payments. This can significantly speed up payment processing and reduce costs associated with traditional methods. Blockchain has the potential to transform the financial system, allowing all assets and liabilities to be native to a blockchain with transactions happening on-chain.

- Digital currency: Blockchain can host various digital currencies, including cryptocurrencies and central bank digital currencies (CBDCs). CBDCs, such as China's Digital Currency/Electronic Payments (DC/EP), are being piloted by central banks and have the potential to reshape the banking and finance sector. Commercial banks, like J.P. Morgan Chase, have also launched their own digital currencies on proprietary blockchains.

- Reduced errors: Smart contracts, a feature of blockchain technology, can automate and enforce the terms of agreements between counterparties. By minimizing the element of trust needed and reducing the risk of human error, smart contracts can help prevent errors in financial transactions.

Overall, blockchain in banking offers cost reduction, enhanced security, faster transactions, digital currency innovation, and improved accuracy and efficiency. These advantages can potentially transform the traditional banking industry and provide customers with more secure and efficient financial services.

Read More:- How to Create a Payment Gateway? Everything You Should Know

How Can Blockchain be Used in Banking?

Blockchain technology can be used in various ways within the banking sector to improve efficiency, transparency, and security. Here are some common applications of blockchain in banking:

- Accounting and Audit

Blockchain's ability to store immutable records can revolutionize the banking sector's accounting, bookkeeping, and audit processes. By reducing paperwork and streamlining traditional methods, blockchain ensures readily available audit records and improves regulatory compliance. Major auditors such as PwC, KPMG, Ernst & Young, and Deloitte have shown interest in blockchain technology.

-

Borrowing and LendingBlockchain has emerged as a transformative technology in the banking industry, mainly through decentralized finance (DeFi). DeFi aims to make financial services more accessible to retail consumers by challenging traditional finance.

In lending and borrowing, blockchain can help reduce the risk of bad loans through robust verification capabilities. Verifying borrower identities and backgrounds enhances banks' know-your-customer (KYC) and anti-money-laundering (AML) capabilities. -

Syndicated LoansBlockchain can streamline the process of syndicated loans, where large loans are provided by a group of banks to corporate clients. This process involves complex coordination and compliance with KYC and AML regulations.

However, blockchain technology allows banks to securely share compliance information, simplifying the process and reducing the time required. In 2017, a consortium of Credit Suisse, Ipreo, Symbiont, and R3 completed a proof of concept for syndicated loans on blockchain systems. -

Trade FinanceBlockchain is well-suited to modernize trade finance, which relies heavily on paper-based processes. By leveraging blockchain, trade finance can transition to rapid digitalization, eliminating the need for fax or mail-based documentation. Blockchain technology can streamline and secure the exchange of trade-related information, reducing delays and inefficiencies in the process.

-

TradingAs exemplified by DeFi, decentralized marketplaces, and exchanges have gained popularity outside the banking industry. Blockchain's transformative potential can revolutionize clearing and settlement operations, which are crucial for trading businesses. Banks may be tempted to embrace decentralized concepts to enhance their trading operations.

-

FundraisingTraditionally, banks have managed various forms of fundraising, such as initial public offerings (IPOs). However, the rise of initial coin offerings (ICOs) challenged this traditional model by allowing start-ups to issue and sell crypto tokens to investors.

While ICOs were controversial, they paved the way for more mature versions called security token offerings (STOs). As the trend of tokenized fundraising continues to grow, banks might explore opportunities to participate in this space.

How Can CodeAegis Help You in Blockchain Development?

CodeAegis, a leading blockchain app development company, offers comprehensive services to guide you in blockchain development.

They provide insights into blockchain applications, specialize in smart contract development, create tailored blockchain solutions, ensure seamless system integration, conduct thorough security audits, and provide training programs.

Trust CodeAegis to harness the transformative power of blockchain technology for your business.

Final Thoughts

In conclusion, blockchain technology offers significant benefits for the banking industry, including enhanced security, efficiency, and improved customer experiences.

Banks must hire blockchain developers with the required skills to leverage these advantages, stay ahead of the curve, and drive digital transformation in the sector.

FAQs

How does blockchain enhance security in banking transactions?

Blockchain provides a decentralized and immutable ledger, ensuring that transactions are transparent and tamper-resistant. This eliminates the need for intermediaries, reduces the risk of fraud, and enhances data security.

What is the role of smart contracts in blockchain banking?

Smart contracts are self-executing contracts with predefined conditions. In banking, smart contracts automate processes such as loan agreements, trade finance, and insurance claims. They ensure transparency, eliminate the need for manual intervention, and increase operational efficiency.

How can blockchain improve Know Your Customer (KYC) processes?

Blockchain simplifies KYC procedures by securely storing and verifying customer identities. It enables banks to access verified customer data from a shared network, reducing duplication of efforts, enhancing data accuracy, and expediting onboarding processes.

About Author

You May Also Like

Things have changed dramatically over the years with new opportunities, techniques, and future advancements. Real estate is the best industry to invest in, though the procedure sometimes irritates. Me

It's no secret that the digital world has transformed many aspects of our lives, and it is only going to continue changing in ways we can't even imagine yet. To help businesses keep up with this rapid

Over-the-top (OTT) platforms like Disney Plus, Netflix, and Prime Video have gradually captured attention as traditional TV-watching methods have faded. Throughout the year, OTT platforms have created

Are you aware that the world is going through a significant shift in the way we make payments? According to a recent report by Deloitte, the total value of digital payments worldwide is estimated to r

Australia is moving towards a big shift at a global level. It is strengthening the ties at the B2B level and becoming a hub for innovation, sustainability, and digital transformation. Backed with a r

Want to establish a new business or improve an existing one? You should consider using blockchain technology Being a distributed database, Blockchain allows for secure online transactions. This techn

When it comes to mobile app development, one of the most important things you need to consider is the prototyping process. This will allow you to create a working model of your app so that you can tes

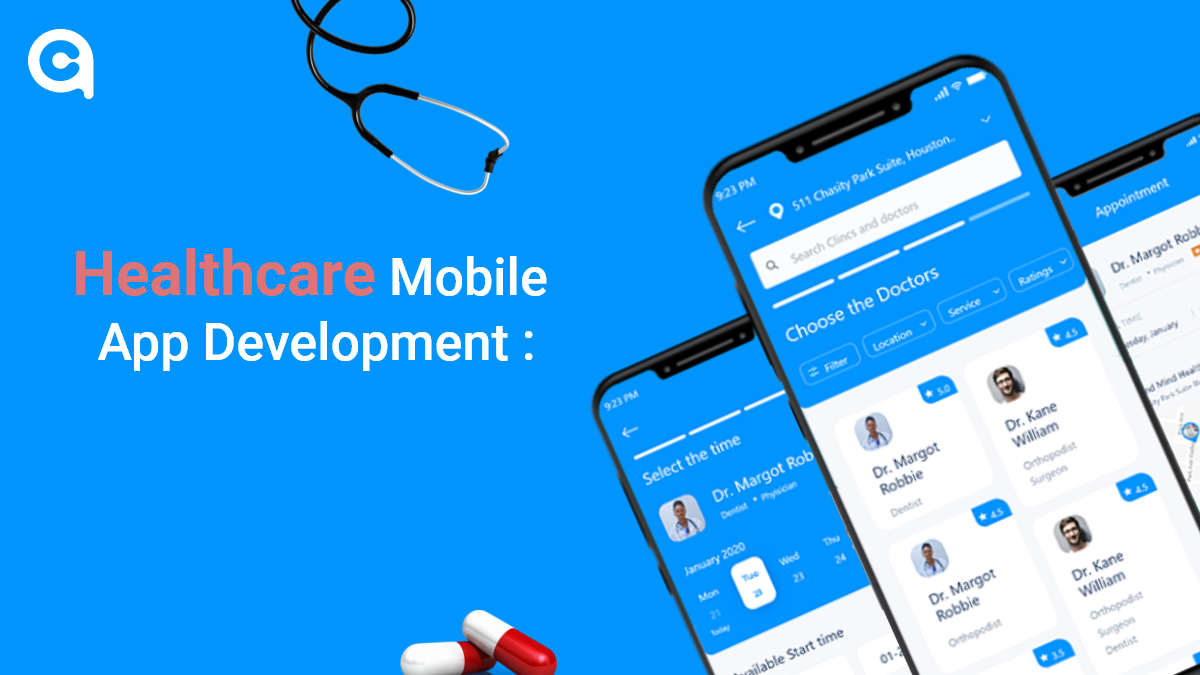

As we head into the future, more and more people are looking to find ways to improve their healthcare. And with good reason - healthcare can be expensive, and it can be difficult to get the right care

The startup space is fast, competitive, and harsh. According to Exploding Topics, about 90% of startups fail. What would be the reason for that? There would be multiple reasons for startup failure, bu

The gaming industry is proliferating with the advent of smartphones and PCs. Every age group, from children to adults, is well-engaged and fond of online gaming. The rapid evolution of mobile gaming a

As the world of startups becomes increasingly competitive, building an MVP is crucial for entrepreneurs looking to test their ideas and launch successful businesses. By creating a minimum viable produ

Picture this - a world where business transactions are seamless, secure, and transparent. This might have seemed like a distant dream before the advent of cryptocurrencies and blockchain technology, b

Do you run your own business and want to build an Android app? If yes, you must know about the latest technology trends playing a significant role in the android app development process. Technology i

Have you ever found yourself in a situation where you desperately needed a product or service but didn't have the time or energy to go out and get it? Well, fear no more because on-demand delivery app

If you’re in the healthcare industry, then you know that data privacy and security are of utmost importance. In order to protect patients’ information, the Health Insurance Portability and

Are you looking to design a mobile app in 2025? Mobile application development is an ever-changing field, and it can be hard to keep up with the latest trends and best practices. But with this guide,

Rental businesses are gaining market share by offering essential services that help other businesses minimize downtime and maximize profitability. This growth trend is particularly strong in the servi

The rise of online video streaming services has revolutionized the entertainment industry, prompting businesses worldwide to explore the possibility of launching their own platforms. With giants like

If you’re planning to enter the fast-growing fantasy sports market, one of the most critical aspects considered is “What will it cost to build a fantasy sport that stands out and drives t

Over the past decades, the healthcare sector has continuously expanded its wings, moving from traditional to advanced technological processes. This evolution is driven by the sector's unwavering commi

Technology has come a long way in the past decade, and augmented reality (AR) is one of the most exciting development fields. AR technology superimposes digital content into the real world, creating a

Businesses after COVID are going through several changes, and the food industry is no different. Restaurants that have been doing dine-in are now struggling to keep up with the demand for delivery and

Table of Contents 1. What is ChatGPT? 2. What Are the Top Benefits of ChatGPT? 3. How Does ChatGPT Work? 4. Challenges With ChatGPT 5. ChatGPT and the Future of AI 6. Final Thoug

The food delivery application has innovative, game-changing features that will transform the industry from the bottom to the top. According to Statista, the online food delivery market in the UAE has

Table of Contents 1. What is Flutter? 2. Why Choose Cross-Platform Development? 3. Why is Flutter the Best Platform to Make Cross-platform Applications? 4. How Much Does it Cost to

Do you want to build a simple app for your business? Do you want to create an app that enhances the experience of users who play games on their smartphones? Whatever your reason, I have created this g

In today's digital world, businesses must keep up with ever-increasing consumer expectations and find new ways to engage their audience. That's where Progressive Web Apps (PWAs) come in. PWAs are a r

Depending on what niche you’re in, video chat apps are becoming increasingly common in the world of business and technology. Whether it’s a small startup company or a multinational corpora

The United Arab Emirates (UAE) is flourishing as the hub for blockchain technologies, transforming the digital ecosystem and having a forward-thinking government to maintain its competitive edge. Gove

Blockchain technology has been a hot topic recently due to its potential to revolutionize various industries. Blockchain is a distributed ledger technology that ensures transparency, security, and dec

Lately, the tech world has been abuzz with talk of the Metaverse, a groundbreaking concept that promises a shared virtual space where people can interact and engage with one another. This futuristic i

Nowadays, the digital presence has revolutionized business dynamics. App development is not just evolving but breaking traditional barriers and emerging as strong and progressive solutions. With robus

In recent years, the gaming industry has seen a surge in popularity, with many gamers turning to online gaming platforms and console games in order to escape reality. With so many people playing video

DeFi is a new kind of investment that’s taking the world by storm. So what is it? Essentially, DeFi is a digital asset class that allows you to invest in cryptocurrencies and other digital asset

Blockchain technology is becoming the heart of multiple industries. It is robustly securing businesses through its core value, making it the first pick-up in the generative AIs. The blockchain is the

Summary: Car rental apps have become the heart of the business, stimulating growth, efficiency, and customization. They offer updated rental methods to stay relevant with Gen Z and Millennials, who ar

With the ubiquity of smartphones and tablets, it only makes sense that mobile app development - which is the process of creating applications for smartphones and tablet devices - is becoming more popu

The mobile app market has grown to a staggering size, with over 1.8 million apps available in the Google Play Store and Apple App Store combined. Mobile apps have become a necessity for people worldwi

Have you ever felt like you’ve attracted 30% more consumers to your shopping sales by using a technical hack to revive your shops? It would work like a person was crossing through next to your

You’ve likely heard the term “Artificial Intelligence” or AI until now—It’s 2025. But have you ever paused to consider how deeply AI has woven itself into the web of our

The launch of Node.js 19 is now available! It substitutes Node.js 18 as the current launch line, with Node.js 18 being encouraged to long-term support (LTS) next week. What do these two launches mean

The UAE, and Dubai specifically, has really evolved from just a real estate and tourism market, and is quickly becoming a hub for digital innovation and online commerce. With the continued investment

Can you give thought to a week without coffee breaks at cafes? It might not be possible, but earlier, having coffee outside the house was never a thing. So how the tables have changed the corners?

As blockchain technology continues to evolve, so too does the landscape of projects built on its foundation. The worldwide Blockchain market is predicted to expand at a CAGR of 42.8% (2018-2023), dire

Prime Minister Narendra Modi eventually launched 5G in India at the 6th edition of the IMC (India Mobile Congress). Reliance Jio and other telecom organizations documented the various use cases of 5G

Building an App that promotes businesses and acts as a right hand has a separate fanbase! Creating an app for the business plays a fundamental role in elevating business operations, making seamless c

Sipping coffee and thinking of a startup has always been trendy. Similarly, hanging out with friends and promising them to start a business someday feels refreshing. Did you know that several success

Imagine a classroom where history comes alive in the 3D model of historical events. Biology students can explore the unique complexities of a cell as they have practiced it with real-world examples, a

An extensive background working in Tech, Travel, and Education Industries. Currently involved in entire business operations process: Benefits strategy and implementation, systems integration, Human Re

The beacon technology market was valued at 519.6 million U.S. dollars in 2016, and it was estimated to increase at a CAGR of 59.8% to reach about 56.6 billion U.S. dollars in size in 2026. Throughout

Mobile applications have dominated the market, helping businesses to reinforce their full potential. Not only for the rental business, but mobile apps play a critical role in establishing a solid foun

Decentralized Finance (DeFi) is a modern and evolving region of finance that is less centralized and more open to innovation and collaboration. DeFi enthusiasts laud its prospect of disrupting convent

The introduction of online payment applications has changed how people perform financial transactions. A mobile phone with a banking app lets you quickly resolve various financial matters. Ta

Nowadays, the financial industry has encountered massive digitization, and mobile apps play a significant role in it. There are a wide variety of money transfer apps available, catering to the needs a

Generative AI? Is this still a question mark to you? If you don’t know what generative AI does, that would be a fair question, but it was not if you said that you haven’t interacted with

The mobile app market has grown to a staggering size, with over 1.8 million apps available in the Google Play Store and Apple App Store combined. Mobile apps have become a necessity for people worldwi

Social media apps are all the rage these days. People use them to connect with friends and family, to learn about new products and services, and to stay up-to-date on the latest news. But as popular a

Do you know what digital transformation with AI is and how it can impact your business? Organizations today are under pressure to digitally transform to stay competitive. This digital transformation

Gone are the days when people used to wave down a taxi on the street or wait for one at the airport. With the advent of technology, people can now book a taxi with just a few taps on their smartphones

Will DeepSeek and ChatGPT collide in the race for AI Supremacy? DeepSeek and ChatGPT are at the center of a heated debate that tends to shape the future of AI. The real-world implications and effecti

Imagine a world where you can speak your thoughts and desires, and the digital realm responds promptly, seamlessly integrating into your daily life. Whether you want to search for information, contro

Hiring a team of remote developers can be a daunting task, but it doesn't have to be. With a little bit of planning and the right approach, you can find the perfect candidates to build your dream prod

Google released Android 13 beta 4 to the public, and with it comes a slew of new features and updates. In this article, we'll walk you through everything you need to know about the latest version of A

Necessity is the mother of invention origin! Have you ever wondered when an entrepreneur decides to start a business? When demand is high and supply is low, opportunities arise. But there’s mor

In the last few years, wearables have become increasingly popular. Fitness trackers, smartwatches, and even smart glasses are becoming more and more commonplace. And as the technology improves and bec

Picture this: a world where traditional banking transforms into a cutting-edge, efficient, and transparent system that leaves everyone in awe. Blockchain, often met with skepticism and uncertainty, is

When it comes to developing an app, there's a lot to consider. Not only do you need to create a user-friendly interface and design, but you also need to make sure your app is able to meet the demands

Application development is essential to fostering business efficiency while accepting new changes. Depending on the specific requirements, 85% of businesses rely on software development solutions to s

With the advent of technology, the financial industry has experienced a massive transformation in the past few years. Fintech applications have revolutionized the way we manage and invest our money.

Augmented Reality and Virtual Reality are the two leading buzzwords in the technology era. What began as a completely new, significantly different technology has rapidly revolutionized into something

Did you know that Dubai's prime residential market is projected to experience the world's strongest growth in 2025? The Middle East is buzzing with opportunities, especially in the realm of mobile app

The two hottest frameworks in the mobile app development world are Flutter and React Native. They’re both cross-platform solutions that allow you to write code once and deploy it to Android and

IPTV has established itself as a prominent technology that is gaining traction with its comprehensive platform applications. Unlike traditional methods like satellite, cable, or TV, IPTV has accelera

The world is digitizing at a very rapid pace, and in such a scenario, real estate businesses must also go digital to stay ahead of the competition. One of the best ways to digitize your business is de

The healthcare industry is one of the most rapidly changing and growing industries worldwide. Mobile devices and apps have drastically changed how providers and patients interact and communicate.So, i

Mobile applications play a vital role in the development of multiple businesses in this digital world. Most companies are investing in iOS app development to strengthen their market appearance and dra

Blockchain technology and web development are two powerful innovations that have the potential to transform our world. While they may appear distinct, they share similarities and can work together to

Having a mobile application is no longer a luxury—it's an essential tool for instantly capturing the market! To stand out in the rental businesses, a company must adopt tech-driven preferences

Is your business still relying on off-the-shelf software solutions that don’t efficiently meet your unique business requirements? If your mind instantly says yes, then let’s explore why in

Businesses these days are looking to have an edge over their competition by having a strong online presence. A website is not enough anymore, and many companies are turning to mobile apps as a way to

By 2024, we all know that technology will be the future. What excites me the most is that technology has covered all the dimensions of businesses, enabling them to attain their potential and efficienc

Mobile app development is quickly becoming a necessity for businesses. As the world becomes increasingly digital, companies of all sizes rely on mobile apps to reach customers and increase customer en

The world of gaming is rapidly evolving, and the latest buzzword is "metaverse." The term refers to a virtual world where users can interact with each other and digital objects in real time, using imm

Leave a Reply

Your email address will not be publishedDO YOU HAVE ANY PROJECT

Let's Talk About Business Solutions With Us

India Address

57A, 4th Floor, E Block, Sector 63, Noida, Uttar Pradesh 201301

Call Us

+91 853 500 8008

Email ID

[email protected]

.jpg)